Activision Blizzard Stock Sinks 15% After Earnings Report, Erasing ~$10B In Market Value

All the drama surrounding Blizzard must be having an impact on the company, as Activision Blizzard stock plunged 15% the day after releasing their earnings, down almost $12 per share, which wiped nearly $10B from the company's market cap (market value of the entire company).

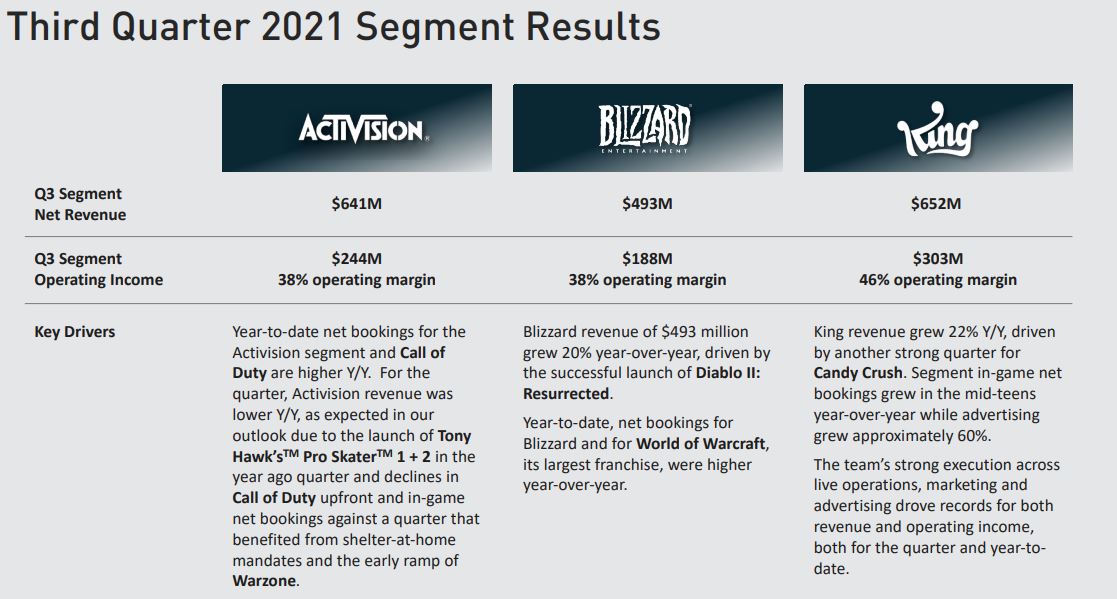

While Revenues were in-line with Wall Street expectations ($1.88B), profits were actually higher than expected ($639M profit) , but the company's forecast for Q4 was much weaker than expected. Analysts were expecting $2.92B in revenue for Q4, but Activision Blizzard came out today and said they expect only $2.78B. This is a massive difference for a company that's long bene touted as a high-growth gaming company. Backlash from Blizzard's community is clearly having some impact on the company's forecast.

The company is also expecting a later launch date than originally expected for Overwatch 2 and Diablo 4 (originally planned for 2022 launch, but now delayed into at least 2023). On the positive side, Call of Duty's playerbase has been steady year over year on consoles and PC while growing on mobile. World of Warcraft's revenue and engagement was at a decade high for period outside of a modern expansion year (thanks to the continued success of Classic).

Monthly active users company-wide were 390 million. Activision had 119 million; Blizzard had 26 million; and King had 245 million.

Further Reading: Activision Blizzard Q3 2021 Investor Presentation